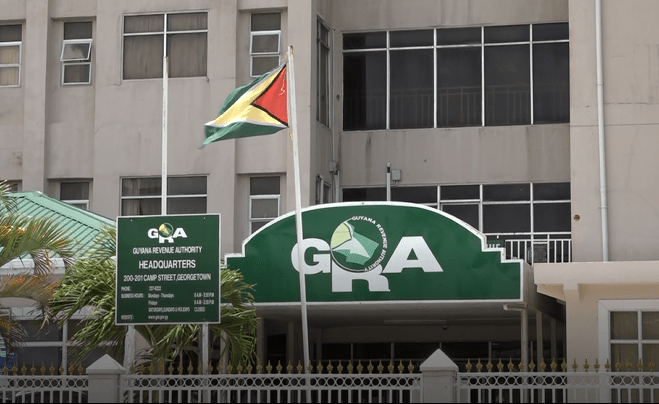

See full statement from the Guyana Revenue Authority:

The Guyana Revenue Authority (GRA) once again advises members of the public against the falsification of documents and/or attempts at colluding with anyone, including GRA officers, to defraud the Authority in the course of completing a transaction.

Persons guilty of such unlawful actions are liable on summary conviction to fines and imprisonment of up to as much as six months, depending on the nature and severity of the offence. The Authority also reminds the public that employees are NOT authorised to collect monies from taxpayers for any transaction or offer to complete transactions in exchange for gifts.

With respect to obtaining provisional driver’s licences, GRA reiterates that applicants must first receive the Original Pass Letter from the Traffic Certifying Officer of the Guyana Police Force. Any other source or means used to acquire this document is fraudulent.

Further, taxpayers must make all payments at the cashier sections and obtain an official GRA receipt as proof of payment. Cashiers are located at GRA’s headquarters, all Integrated Regional Tax Offices (IRTOs), and the Guyana Post Office Corporation (GPOC) building. Moreover, GRA has repeatedly published alternative payment options available through the following entities:-

• Online banking services at Republic Bank, Demerara Bank, Scotia Bank and GBTI.

• Mobile Money Guyana (MMG)

• Bill Express (over the counter)

Persons who suspect that they are the victims of frauds should request the name and employee ID of the person representing the Authority and report the matter (anonymously) to GRA’s Special Investigation Unit’s (SIU) hotline 225-5051 or via email to [email protected].