The process of disposing of vehicles seized by the Guyana Revenue Authority (GRA) for want of entry, is one fraught with a number of challenges, including auto dealers trying to circumvent the system to purchase cars at below market prices.

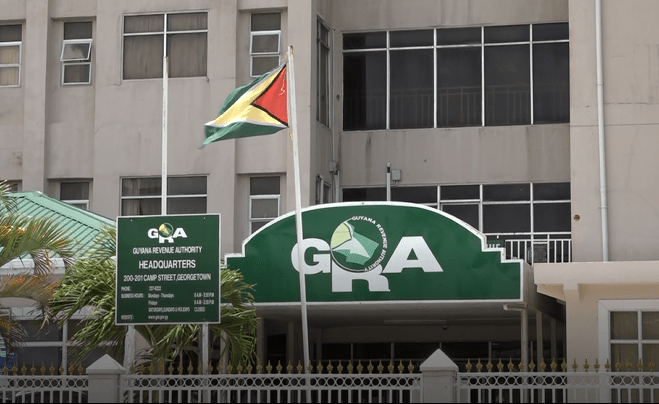

These matters were discussed on Monday when GRA Commissioner General Godfrey Statia and members of his senior management team came before the Public Accounts Committee (PAC) of the National Assembly.

According to GRA Comptroller Rohan Beekhoo, the agency has had to come up with ways in which they could handle dealers, who would seek to skirt the system to purchase seized vehicles below market prices, for resale.

“Any flexibility to be given to those importers, would be done during that process, when that vehicle is gazette and they do make that representation. It is at that point. After that, now the thing with dealers is its twofold. What the dealers have been doing, they’ve been looking to get the vehicles and bid cheaper, as much as possible.”

“Now when we cut that out, the dealers resorted to another thing. They put people to bid high on these vehicles. So, when they bid high on those vehicles, those vehicles would be left on the wharf, so that they can get their sale. So, we end up stuck with those vehicles, hence things end up rotting. So the dealers actually trying a twofold smartness on us.”

Meanwhile, Statia also defended against findings of Auditor General Deodat Sharma, that want of entry vehicles were donated to other agencies or even removed from the auction line up, resulting in lost revenue.

As many as 194 bids were received for 36 of these vehicles. However, the AG had found in his 2018 Audit Report that the removal of nine vehicles resulted in millions of dollars in losses. However, Statia requested a breakdown of the $14.4 million quoted by the AG.

“There are many persons who bring vehicles in. And they do not clear it on a timely basis. As soon as those vehicles are now advertised, those persons who brought it in, write a letter saying they’re sorry their late, they’ll pay the want of entry charges and the taxes,” he said, adding that this even happens after the vehicles have been gazetted.

“You do not want to seize people’s vehicles unnecessarily, notwithstanding the law says so. Because if they are going to pay the taxes, in many instances vehicles are sold for less than the taxes due. So, if the taxpayer or importer decides to pay the want of entry charges, writes a letter requesting it be removed from want of entry, I approve it.”

Meanwhile, the issue of trade plates, which are temporary licences used on a new vehicle until it is registered, also came up. According to PAC member Juan Edghill, he routinely sees vehicles trade plates being used. However, Statia took pains to distance his agency from the misuse of these plates and suggested that the Police clamp down on these vehicles.

“Until we regularise trade plates and regularise a proper system of vehicle registration, we are going to have this problem all the time. And we need to recognise that there is subsidiary information that can be accessed, which would avoid this. Because every vehicle that is imported, for instance we know what is the VIN number.”

“We can use that information and the AG can do that, by going into the licence registration system and you would know exactly where that vehicle is, who is driving it… (and) it is for the Police, recognising under the Road Traffic Act, that these things are being abused and should not be on the road at that time,” Statia said.