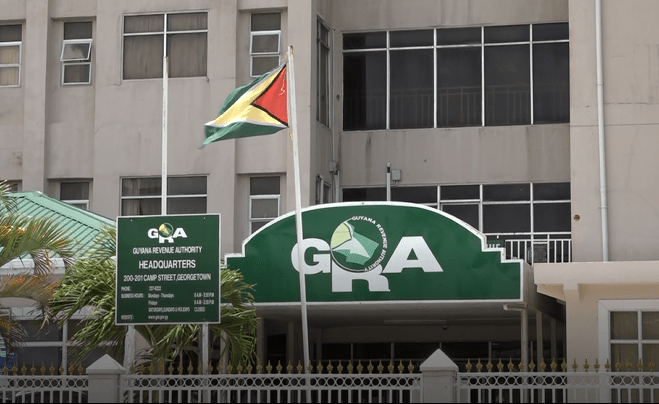

The Guyana Revenue Authority (GRA) collected over $240 billion in revenue in 2021, but the Auditor General has flagged the fact that some 76 per cent of self-employed persons did not file tax returns.

According to the Auditor General report of 2021, 87,267 self-employed persons did not file their income tax returns, out of 114,838. This means that only 27,211 persons, or 24 per cent, filed their tax returns, which totalled $4 billion.

In total, GRA collected $242 billion for 2021 as revenue. Additionally, $255 billion in total was collected and paid over to the Consolidated Fund, which holds Government funds and is housed at the Bank of Guyana.

The Auditor General noted that there were substantial shortfalls in income tax on the self-employed. Also falling short were personal and corporate tax, the environmental levy, liquor licence, travel tax and Value Added Tax (VAT) on imported goods and domestic supply.

The excise tax on petroleum products also showed a shortfall in revenue collection. In the audit report, however, GRA explained that for 2021, the revenue target was revised from $242 billion to $254.9 billion.

As pertains the fuel tax, Government has been slashing the excise tax on fuel for a while now, lowering the excise tax rate on both gasoline and diesel, from 50 per cent to 35 per cent in February 2021, then from 35 per cent to 20 per cent in October 2021. This is in keeping with Government’s policy to adjust the taxes on fuel, to mitigate the impact of rising fuel prices on the world market.

In October, Senior Minister in the Office of the President with Responsibility for Finance, Dr Ashni Singh had said that gas prices at the pump charged by GuyOil would be reduced from $269 per litre to $215 per litre.

Additionally, diesel prices were reduced by 15 per cent from $265 per litre to $225 per litre. These changes took effect from October 2, 2022.

Dr Singh had explained that during the first half of 2022, global oil prices surged more than 50 per cent, increasing from US$77 per barrel at the end December 2021 to US$120 in June of this year. In fact, oil prices rose as high as US$137 per barrel primarily as a result of the Russian invasion of Ukraine.

“The impact of the dramatic increases in oil prices were significant and given the interconnected nature of the global economy, translated into higher cost of landing fuel in Guyana. In order to mitigate the impact of rising global fuel prices on domestic consumers and the productive sectors to which fuel is a key input, the Government lowered the excise tax rate on both gasoline and diesel from 10 per cent to 0 per cent in March of this year.”

“It would be recalled that, previously, during the Budget 2022 presentation, the Government lowered the excise tax on both gasoline and diesel from 20 per cent to 10 per cent so as to minimise the impact of rising global oil prices,” the Minister had further explained.